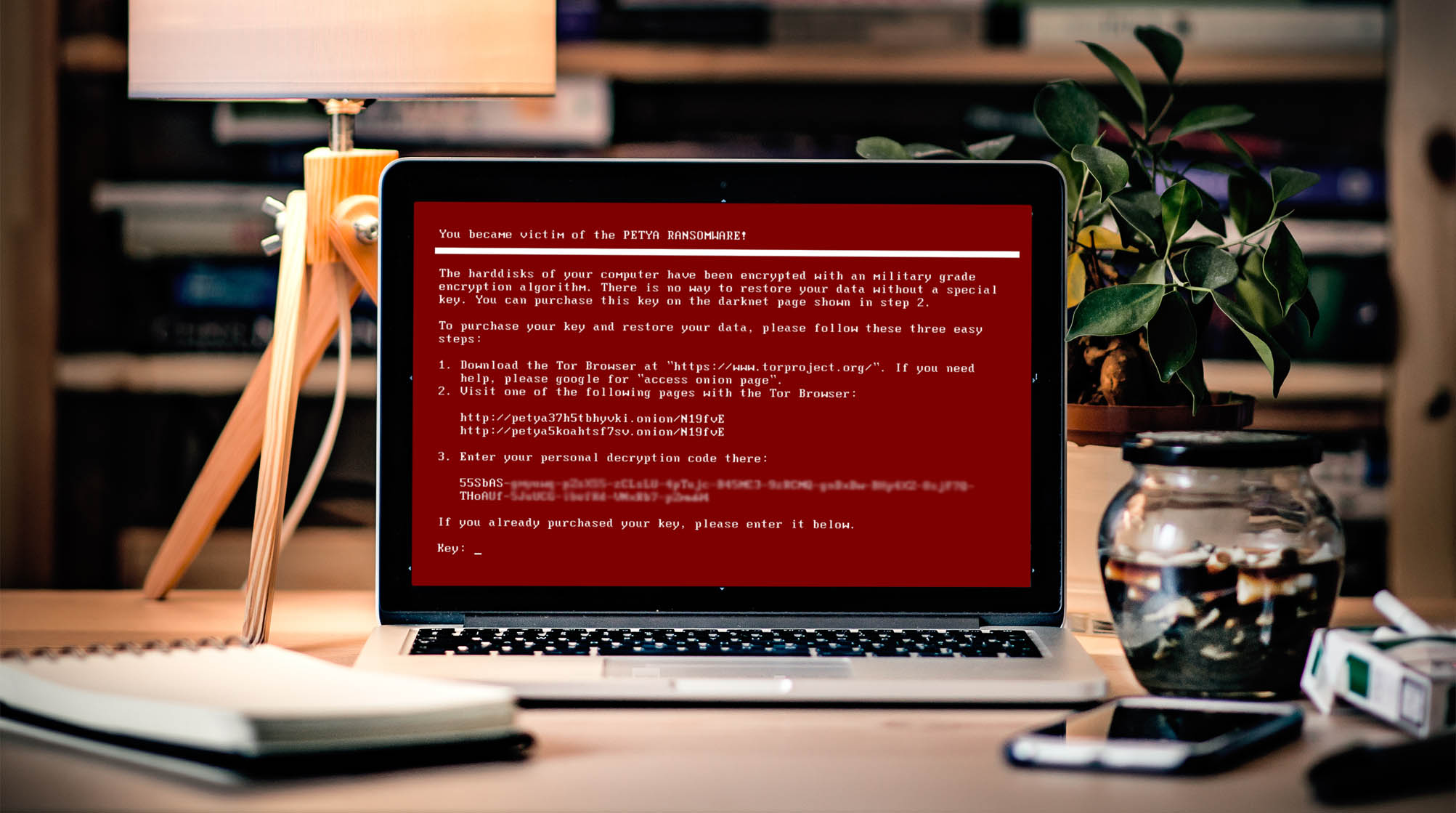

Make Cyber Security Your New Year Resolution

What to look out for in 2018 2018 is set to be a challenging year online with increases in cyber threats and the evolution of Australia's legislative landscape in relation to data breaches. The Notifiable Data Breaches (NDB) Scheme will commence in Australia on 22nd of February. The...