14 Mar Strata Insurance Insights: Building Valuations

While securing appropriate insurance coverage is fundamental for strata property, the significance of having the correct building sums insured can often be overlooked.

In this article, we address the importance of obtaining an accurate building valuation to ensure that the insurance coverage aligns with the actual rebuilding or repair costs, particularly in light of the recent increases in construction costs. By putting a microscope on this topic, we hope to assist strata managers and property owners in avoiding the significant financial risk that could be associated with being underinsured. If a disaster occurs and the insurance payout is insufficient, owners may be responsible for covering the shortfall, which can lead to financial strain and even bankruptcy for some.

What does strata legislation say?

In general terms, legislation requires that strata properties are insured for their full replacement value applicable at the time of a loss, not at the time when the insurance policy was first taken out.

While property owners may be concerned about the costs associated with valuations and accurate building sums insured, taking a proactive approach to ensuring adequate insurance coverage for the property is crucial to avoid being under insured.

Why has there been an increase in Underinsurance?

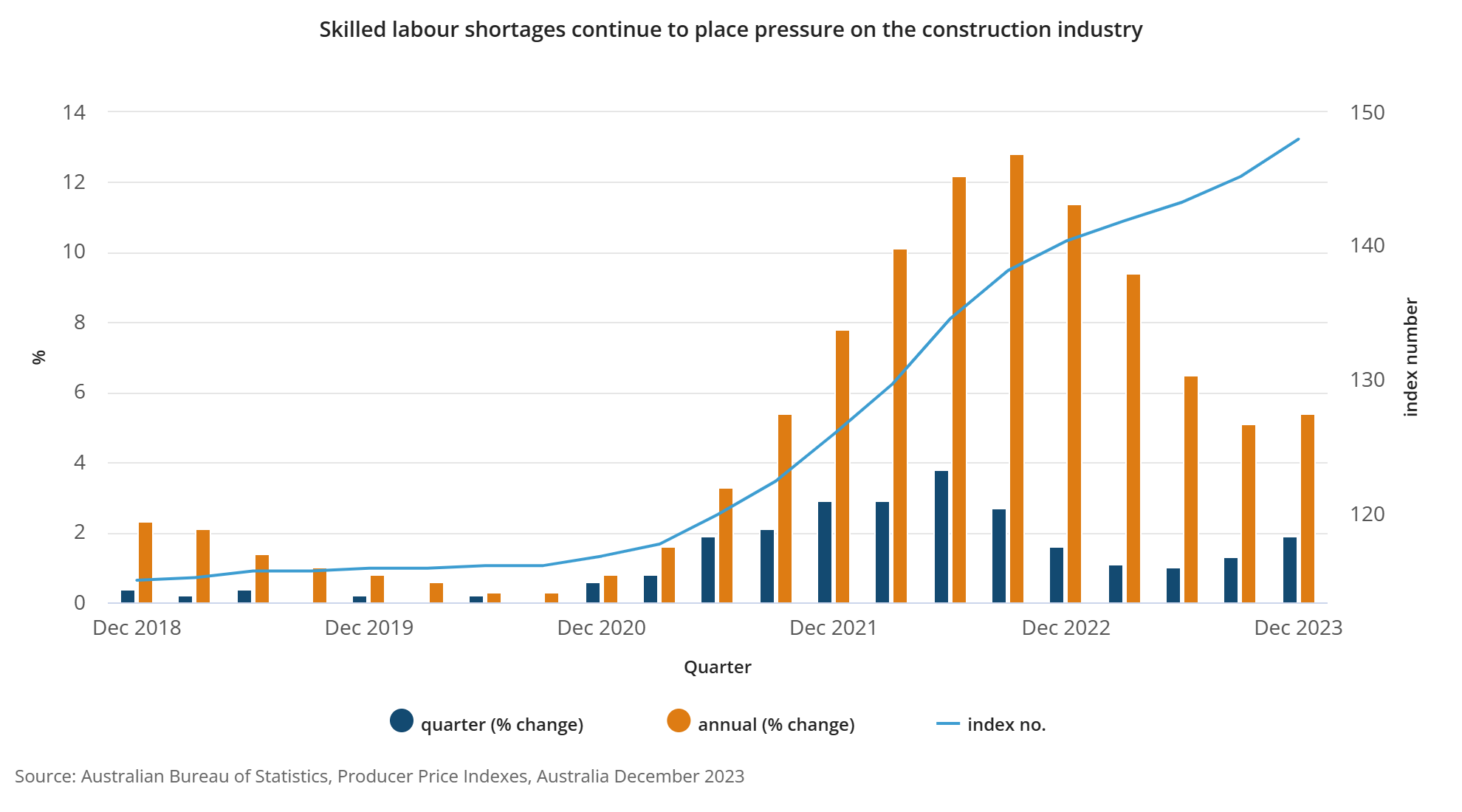

The combination of supply chain issues and weather-related catastrophes over the last few years has led to a significant rise in construction costs. The December 2023 figures from the Australia Bureau of Statistics, show that while growth has eased, the current increases are being driven by ongoing labour shortages for skilled tradespeople, with demand for trades placing upward pressure on costs. The graph below illustrates the construction cost increases each quarter since 2018.

If you haven’t had a building valuation or adjusted your building sum insured on your strata insurance policy in the past few years, then it is highly likely that your building is underinsured.

Why are valuations important?

While valuations for insurance purposes are mandatory in some jurisdictions, even where valuations are optional, they are the most practical way for owners to ascertain with a degree of certainty that they are meeting their legal obligations and avoiding underinsurance. A professionally qualified valuer is key to determining the insurance amounts required for each jurisdiction. Without professional assistance, the owners corporation faces a complex and technical task, leaving them exposed to possible uncapped financial exposure.

How are insurers responding to underinsurance trends?

We have found some insurers are imposing stricter conditions regarding building sums insured and property valuations. These include:

- Requiring a building valuation to be conducted within a specified timeframe after renewal.

- Offering quotations only if a building valuation has been conducted within the past three years.

- Providing a renewal quote whereby the Building Sum Insured is automatically increased by CPI, each year, since the recent valuation (if conducted within three years).

Furthermore, Strata Community Insurance has created a Standard Operating Procedure on Valuations (NSW) for the benefit of strata managers and owners corporations. This document covers the valuation process, from initially engaging with a valuer through to issuing instructions to your customer’s preferred insurance partner.

CRM Brokers strongly recommend strata managers and owners corporations be proactive in addressing the risks associated with underinsurance. If you have a property that you are concerned may be underinsured, please contact CRM Brokers on 1300 880 494 (Option 2 for the Strata Team) to discuss obtaining a valuation.

Stay Informed – Connect with us on LinkedIn

Important Notice

Disclaimer: Terms, conditions, limits, deductibles and exclusions apply to the products referred to above. Any advice in this article is general advice only and has been prepared without taking into account your objectives, financial situation or needs. Before making a decision to acquire any product(s) or to continue to hold any product, we recommend that you consider whether it is appropriate for your circumstances and read the relevant Product Disclosure Statement (‘PDS’), Financial Services Guide (‘FSG’) and the Target Market Determination (‘TMD’) which can be obtained by contacting CRM Brokers.

Information is current as at the date the article is written as specified within it but is subject to change. CRM Brokers make no representation as to the accuracy or completeness of the information. Various third parties have contributed to the production of this content. All information is subject to copyright and may not be reproduced without the prior written consent of CRM Brokers.

Strata Insurance Insights: The Real Cost of Underinsurance

Simply put, underinsurance occurs when the sums insured are not sufficient to co...

11 April, 2024Strata Insurance Insights: Building Valuations

While securing appropriate insurance coverage is fundamental for strata property...

14 March, 2024The Alarming Rise of Business Email Compromise and the Vital Role of Cyber Insurance

In today’s rapidly evolving cyber threat landscape, cybercriminals are con...

27 February, 2024Navigating High-Risk Tenancies and Property Insurance

When it comes to insuring properties with commercial tenants, regardless of whet...

13 February, 2024