01 Oct Public Liability circa 2000s revisited?

Public Liability circa 2000s revisited?

The answers to today’s problem may lie in the past.

It seems like a lifetime ago when the cleaning industry was going through one of its worst periods in relation to the purchasing and renewal of public liability insurance.

I remember it well. There was the collapse of HIH, which sent premiums through the roof. Insurance became almost impossible to obtain for many industries and occupations. However, the problem was evident some years before that. Often, insurers had been settling claims without consulting the insured, leaving them unaware as to the long-term effect it would have on their renewals. Moreover, some would ask, how could insureds manage their risk exposures when they did not know there was a problem? Basic policy excesses started at $250!

HIH’s departure from the market nonetheless revealed an underlying problem and the insurance world of unsustainably low premiums ceased to exist almost overnight as a result.

The cleaning industry had been hard hit. I saw businesses desperate to obtain insurance and a number of them were unable to continue honouring their contracts because they were uninsured. The answer to this problem was not as simple as finding an insurer, but rather, an inward look to see what the cleaning industry could do to clean up its own claims history.

There was a solution; but it was not a quick fix. The industry needed to focus on risk management. The perception was such, that from an extreme point of view, if there were no claims, then the insurer should have little reason to decline renewal. Well, yes and no.

Insurers made assessments based on their book’s overall performance rather than generally that of the individual cleaner. Therefore, if an insurer decided that they could no longer offer public liability insurance to cleaners, they more or less, stopped underwriting them altogether. There were exceptions however. There always are.

Cleaners started to reconsider the contracts they had in place with Property Owners and Managers, from which claims stemmed or were re-directed. They also started to focus on the contract clauses, specifically the insurance and indemnity clauses, as cleaners were often accepting the liability, whether or not they were negligent. That also led to other issues pertaining to contractual liability exclusions and policies not responding to claims.

All the while, the available market for the cleaning industry’s public liability almost became non-existent.

During that period, we were able to arrange policies both locally and via London. There were very few choices but what we had to do was to show underwriters that the cleaning industry, i.e. our individual clients, were making significant changes to the way in which they managed their risk exposures and claims. Documenting those changes was the first step. The application of those changes occurred immediately thereafter.

That meant for some, making a decision to walk away from contracts where the claim numbers were high e.g. retail cleaning during business hours. And, in doing so, others who had developed their business model around claims management and risk minimisation picked up those very same contracts.

The Civil Liability Act 2002 did bring some ‘calm’ however; its impact took years before it filtered through to reducing the number of new claims.

Over those years, the cleaning industry began to focus on risk management. It became cautious, prudent and at times, somewhat dismissive of new contracts, all for the sole purpose of protecting its claims history, reducing costs and maintaining both its contracts and insurance.

So what has changed since that unnerving period? Quite a lot actually. Insurers’ profits had returned, capital entered the market in abundance and rates began to drop. Insurers, both locally and from London started to re-enter the market all bidding for a healthy portion of the cleaning industry’s premium.

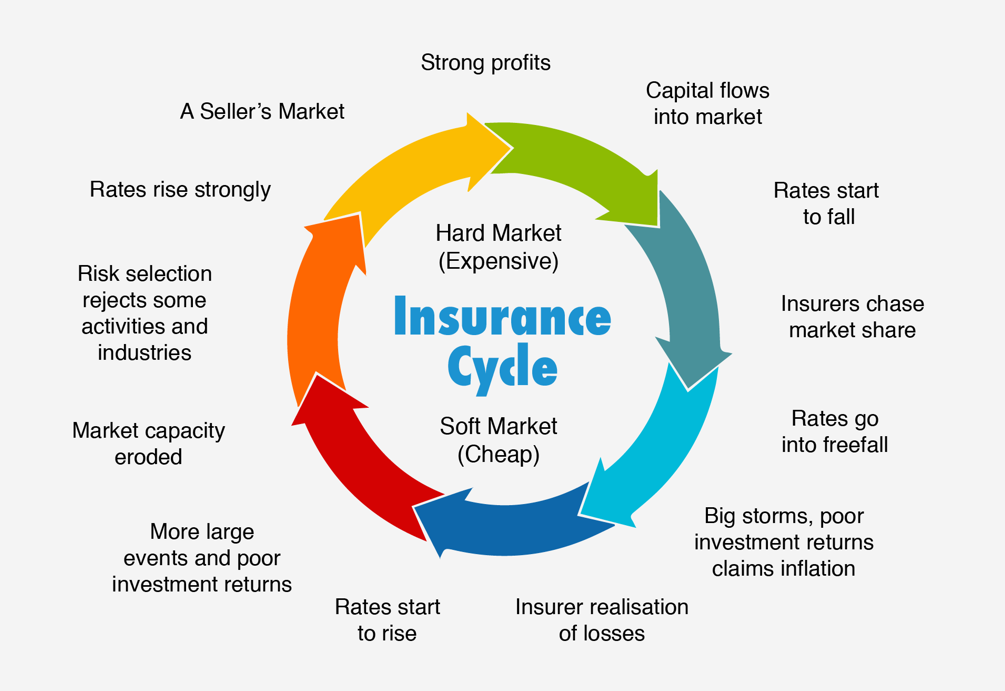

Referring to the Insurance Cycle (below), rates started to fall, brokers were providing quotes from all over the market and cleaners were provided with (far too) many choices. Policies were moving from one insurer to the next, as the pursuit of the lowest premium became the driver. However, during the last ten years, many cleaners lost their focus on risk management. There was also an increase in the accepting of new cleaning contracts where the claims exposures were far from favourable, but were overlooked, due to the desire (and need) to attract new business.

Today’s market is almost a return to 2000. Not necessarily for the same reasons as back then, but rather because the insurance cycle does not actually stop.

A number of people have asked me what is going on with Public Liability today, and why are insurers no longer offering to renew policies? The answer lies in the past, but is most certainly applicable in today’s market.

The following is an extract from an article that I wrote for INCLEAN Magazine back in February 2005:

Risk Management a winner

Those that can show they have successfully implemented risk management into their insurance program, having moved away from contracts generating large turnover and a large volume of claims, and move towards contracts that are profitable and sustainable will be the first to benefit.

But beware, reductions in premium or deductibles should not mean a slackening of practices that improved the views towards this industry from an insurer’s perspective. In fact, it should reinforce a continuation and persistence of those same practices.

CRM Brokers has worked closely with a number of insurers over the last six years, educating and advising underwriters of the changes your industry has made to risk management. We are now seeing the benefits as we have enough data to show claims and risk management experience – something that wasn’t available in the late 90s.

New insurers may continue to come into this market, attracted by the ‘profitable’ dollar, but buyer beware. When times were tough, those same insurers did not want to know about this industry. And they don’t have the experience nor have they written the premium volume over the past number of years to give us the confidence we seek for our clients’ placements.

So, if in their attempt to gain a quick dollar, they price your insurance at a level that’s unsustainable, you could well end up back on the rollercoaster if the market were to shift again. Seek consistency combined with experience.

No, I didn’t have a crystal ball back then, but rather the benefit of experience. My words from 2005 have hauntingly applied over the last five or more years.

The market is close enough to being at its tightest right now. We are experiencing the “risk selection/rates rise strongly” part of the insurance cycle.

When you work with CRM Brokers, we will do what is necessary to implement a risk management program so that we may confidently enter the market. Experience in these times is paramount. Unless there is a change in the submission that you provide your insurer, the result is most likely going to be that you will be hit hard, i.e. a substantial premium increase or non-renewal of your insurance, meaning you’ll be uninsured. It is not too late to do something about it; but for some, it is getting close.

For more information or assistance with your insurance programme, contact Damien Coorey – NSW/ACT NIBA Broker of the Year 2019 on 1300 880 494 or [email protected].

Stay Informed – Connect with us on LinkedIn

Important Notice

This article provides information rather than financial product or other advice. The content of this article, including any information contained in it, has been prepared without taking into account your objectives, financial situation or needs. You should consider the appropriateness of the information, taking these matters into account, before you act on any information. In particular, you should review the product disclosure statement for any product that the information relates to it before acquiring the product.

Information is current as at the date the article is written as specified within it but is subject to change. CRM Brokers make no representation as to the accuracy or completeness of the information. Various third parties have contributed to the production of this content. All information is subject to copyright and may not be reproduced without the prior written consent of CRM Brokers.

Strata Insurance Insights: The Real Cost of Underinsurance

Simply put, underinsurance occurs when the sums insured are not sufficient to co...

11 April, 2024Strata Insurance Insights: Building Valuations

While securing appropriate insurance coverage is fundamental for strata property...

14 March, 2024The Alarming Rise of Business Email Compromise and the Vital Role of Cyber Insurance

In today’s rapidly evolving cyber threat landscape, cybercriminals are con...

27 February, 2024Navigating High-Risk Tenancies and Property Insurance

When it comes to insuring properties with commercial tenants, regardless of whet...

13 February, 2024