09 Nov With recent escalations in inflation have you considered if your property is underinsured?

With recent escalations in inflation have you considered if your property is underinsured?

Recent escalations in construction costs mean that if your property has not been valued in the past 12 months, there is a likelihood it is underinsured.

The importance of having adequate levels of insurance is more critical than ever given the proverbial perfect storm of events that has led to contractor shortages and soaring inflationary costs across the construction sector.

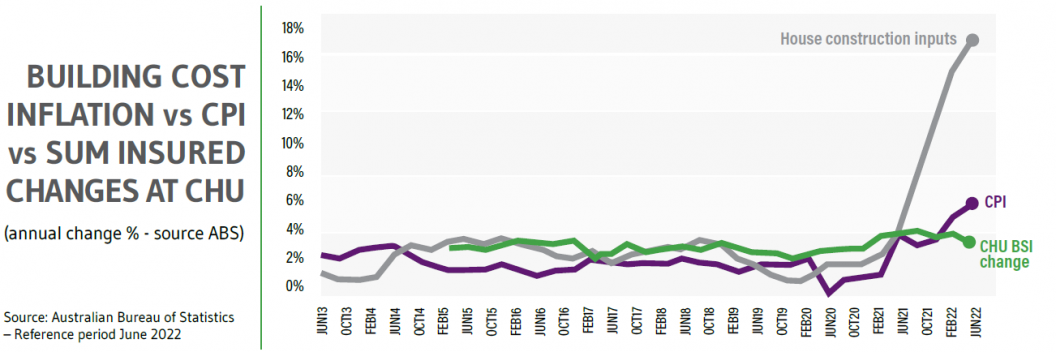

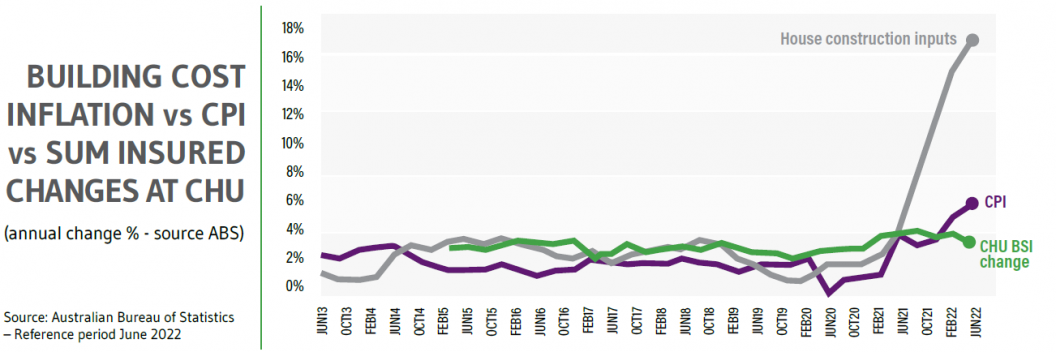

In recent correspondence, CHU Underwriting Agencies provided the graph below, which demonstrates how sharply the cost of construction has risen and is well outpacing CPI, with the steady increase seen from the advent of COVID now a far steeper increase for in 2022. When you overlay CHU’s actual sum insured profile from across it’s strata property portfolio, it is clear that sums insured are not even keeping pace with the CPI% in the graph, let alone the construction pricing index.

Source: Australian Bureau of Statistics – Reference period June 2022

Regardless of specific legislation across Australia, it is important to ensure that property owners will have adequate protection for their asset.

Frequency of catastrophe events continues to rise, which could mean the chances for an insured to suffer a loss are also on the increase.

CRM Brokers strongly implores all clients to review when their property sum insured was last updated and obtain a valuation if necessary.

If you have any questions or would like to discuss sums insured, please feel free to contact your CRM Broker on 1300 880 494.

Important Notice

This article provides information rather than financial product or other advice. The content of this article, including any information contained in it, has been prepared without taking into account your objectives, financial situation or needs. You should consider the appropriateness of the information, taking these matters into account, before you act on any information. In particular, you should review the Product Disclosure Statement (‘PDS’), Target Market Determination (‘TMD’) and Financial Services Guide (‘FSG’), which can be obtained by contacting CRM Brokers or downloading it from the agency’s website before deciding to acquire, or to continue to hold, this product. Insurance policies issued by various insurers often differ.

Information is current as at the date the article is written as specified within it but is subject to change. CRM Brokers make no representation as to the accuracy or completeness of the information. Various third parties have contributed to the production of this content. All information is subject to copyright and may not be reproduced without the prior written consent of CRM Brokers.

Defect Remediation & Maintenance in Strata

Strata committees often ask why the presence of outstanding defects or maintenan...

27 February, 2025The Rising Risk of Tobacco Retailer Tenants for Strata and Property Owners

Earlier this year we wrote an article about high-risk tenants for strata and pro...

03 December, 2024Holiday Trading and After-Hours Information

CRM Brokers wishes you and your family a very Merry Christmas and we look forwar...

04 November, 2024The Importance of Police Reference Numbers for Claims

At CRM Brokers, we are committed to making our client’s claims experience ...

30 October, 2024