11 Jul Cyber Safety at Tax Time

Cyber Safety at Tax Time

Tax time is not just a busy time for individuals and small businesses, but also a prime time for cybercriminals.

Scammers are becoming more sophisticated, so sometimes it can be hard to know whether a message is really from the Australian Taxation Office (ATO) or a scam. In 2017, the ATO received over 81,000 reports of scams with $2.3 million reported lost and almost 10,000 people divulging personal information.

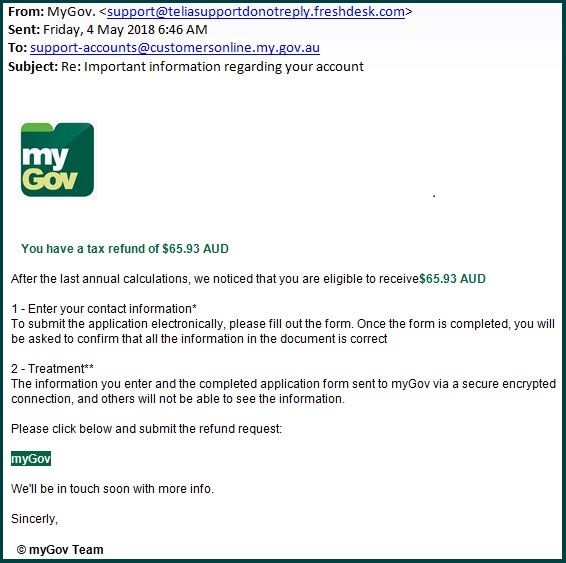

The email, which has the subject line ‘Important information regarding your account’, includes the myGov logo and claims to be from the myGov team. Instead, the email is a phishing scam designed to steal your personal and financial information.

The email asks you to click on a link to claim your refund. If you click the link a fake tax refund claim form will open in your browser.

The form asks for your name and contact details, your myGov password and your credit card number. After you supply this information and click the ‘Continue’ button, you’ll be automatically redirected to the myGov website. By then it’s too late and the scammer has your details.

The scammers use this information to commit credit card fraud and identity theft. If you receive an email like this one, do not click any links or open any attachments.

Remember: the ATO and myGov will NEVER send an email or SMS asking you to click on a link and provide login, personal or financial information, download a file or open an attachment.

How you can protect your business

Be Alert – If you’re a business owner, criminals can use stolen information such as your AUSkey to commit tax fraud in your name or your business’ name.

Beware of anyone asking you to ‘confirm’ your details, purchase a service, update registrations, process your activity statement or refund or pay invoices.

Remember: the ATO will not ask you to make a payment into a bank account not held by the Reserve Bank, nor will they ask for payment via gift cards (such as iTunes cards) or via money transfer. They will not demand a payment in Bitcoin or pre-paid credit card. You can check payment methods by visiting the ATO website.

Five simple ways to protect your business from scammers this tax time

The end of the financial year isn’t just a busy time for businesses – it’s also a prime time for cybercriminals who try to steal your information and money.

It’s a good time to stop and remind your employees of the increased risk and the simple steps you can reduce the risk to your business.

Know the status of your tax affairs

Sometimes it can be hard to tell if a message is really from the Australian Taxation Office (ATO) or a scam. You’re less likely to fall victim to a scam if you’re aware of the details of debts owed, refunds due and lodgements outstanding. You can check these regularly by logging into your myGov account or by contacting your registered tax professional.

Monitor your accounts for suspicious activity

Keep an eye on your accounts for suspicious activity. If you notice transactions you didn’t make, contact the organisation immediately to confirm the transaction.

Remove system access

Unauthorised access to systems by past employees is a common security issue for business. Immediately remove access including AUSkey, from people who don’t work for you anymore or have changed roles and no longer require access

Keep your business information safe

Cybercriminals can use information such as your AUSkey to commit tax fraud in your name. Beware of anyone asking you to ‘confirm’ your details. And don’t

share your details unless you’ve checked the person you’re dealing with is who they say they are.

Be smart with social media!

Much like your personal profile, consider what business information you’re sharing publicly. Scammers use information from social media to impersonate you and send emails to your clients requesting information or money.

Where to get help

If you are ever unsure about a request for information or the validity of an ATO interaction, call the ATO Scam Hotline on 1800 008 540.

Which Cyber Insurance policy is right for you?

There is no such thing as an impenetrable system; this is why in today’s digital age Cyber Insurance is a must for your business to mitigate your exposure in the event of a cyber-attack.

In the event of a serious data breach, cyber insurance may provide financial protection for your business. Policies can cover losses arising from hacking, data theft or accidental loss of client information, including the costs associated with cyber response and business interruption.

CRM Brokers will work with you to find the right policy that mitigates your potential exposure from this emerging risk, call us on 1300 880 494, or alternatively complete our online quotation form, click here to start.

Partnership with Stay Smart Online

CRM Brokers are proud partners of Stay Smart Online, an Australian Government initiative designed to help everyone understand the risks and simple steps we can take to protect our personal and financial information online.

Stay Smart Online also provide a free Alert Service to explain recent online threats and how they can be managed. Small business users are provided with easy to understand online safety and security information and solutions to help protect their online safety a privacy.

Sign up to the Alert Service

Stay Informed – Connect with us on LinkedIn

Important Notice

This article provides information rather than financial product or other advice. The content of this article, including any information contained in it, has been prepared without taking into account your objectives, financial situation or needs. You should consider the appropriateness of the information, taking these matters into account, before you act on any information. In particular, you should review the product disclosure statement for any product that the information relates to it before acquiring the product.

Information is current as at the date the article is written as specified within it but is subject to change. CRM Brokers make no representation as to the accuracy or completeness of the information. Various third parties have contributed to the production of this content. All information is subject to copyright and may not be reproduced without the prior written consent of CRM Brokers.

Strata Insurance Insights: The Real Cost of Underinsurance

Simply put, underinsurance occurs when the sums insured are not sufficient to co...

11 April, 2024Strata Insurance Insights: Building Valuations

While securing appropriate insurance coverage is fundamental for strata property...

14 March, 2024The Alarming Rise of Business Email Compromise and the Vital Role of Cyber Insurance

In today’s rapidly evolving cyber threat landscape, cybercriminals are con...

27 February, 2024Navigating High-Risk Tenancies and Property Insurance

When it comes to insuring properties with commercial tenants, regardless of whet...

13 February, 2024